Prices of Guar seed futures is expected to shoot up to as much as Rs 4,600 on NCDEX, supported by projections of a weak monsoon and spike in global crude oil prices, IndiaNivesh said in a research report.

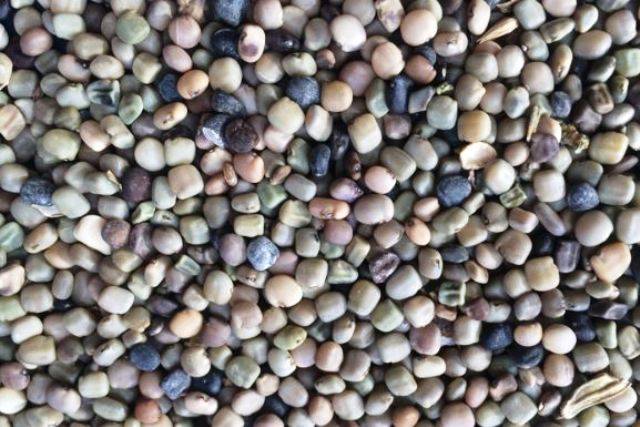

Guar seed is one of the major Kharif commercial crops of Rajasthan. The state contributes around 80% to the total domestic crop. Guar seed and its derivatives - Guar gum is mainly used in oil exploration industries.

Recently, Skymet Weather Services, an Indian private company, predicted that there is a 55% of chance for below average monsoon this year, particularly in during the time (June-September) when Kharif crops are sown.

“Below normal rain during sowing months of June-July could affect sowing of Guar seed this year and lower acreage will support commodity prices,” IndiaNivesh director Manoj Kumar Jain said in the note.

“In our view, lower rainfall and increased demand of Guar gum will support Guar seed prices in coming days. Guar seed could test Rs.4, 600 per quintal levels,” Jain added.

He also noted that production cut by OPEC and allied countries have spiked crude oil prices more than 30% in the first quarter of 2019

“Higher crude oil prices will also support the demand of Guar gum in coming days. As U.S. could ramp-up shell oil production in coming months which will spike demand of Guar gum in coming months,” Jain said.

Guar seed futures at NCDEX corrected from the high of Rs 4,870 in November last year to the low of Rs 4,092 in February this year.

Going forward, IndiaNivesh expects that the commodity will test “the next Fibonacci retracement of 50% and then 61.8% in coming days”.

According to Jain, traders can buy Guar seed futures around Rs 4,390 with the strict stop loss below Rs 4,260 on a closing basis for the upside target of Rs 4,480-4,600.

Weakness is expected in contract only when it closes below 4260 on a daily closing basis and in that case, it could test its support level of 4100 again but chances are very rare, he added.