Bandhan Mutual Fund has introduced the Bandhan Retirement Fund, designed to assist investors in achieving their retirement goals by pursuing long-term capital growth through a blend of equity, debt, and other financial instruments. In a statement, Bandhan Mutual Fund highlighted that the investment fund is a dynamic asset allocation approach that aims to allow investors to benefit from potential equity market gains while mitigating downside risks during market downturns.

The New Fund Offer has commenced on Thursday, September 28, 2023, and will conclude on Thursday, October 12, 2023. Investors can participate in the Bandhan Retirement Fund through authorized mutual fund distributors, online platforms, or directly via the Bandhan Mutual Fund website.

Investment Strategy In Bandhan Retirement Fund

Bandhan Retirement Fund utilizes a quantitative model-driven approach to allocate assets dynamically between equities and debt, aiming to capitalize on market upswings while safeguarding against downturns. The model integrates valuation, fundamental, and technical factors for optimal allocation. It also offers investors the Systematic Withdrawal Plan (SWP) option for post-retirement cash flow management. The fund has a five-year lock-in period to promote long-term investing and compounding.

It focuses on quality equities with sustainable growth and justified valuations, maintaining a minimum 65% equity allocation while incorporating hedged positions for favourable equity taxation. The debt portfolio is diversified with high-quality instruments like GSec, SDL, Corporate Bonds, and Money Market Instruments.

Why choose a Mutual Fund for Retirement?

-

According to data from Amfi as of June 2023, approximately half of the equity assets owned by individual investors are typically held for less than two years.

-

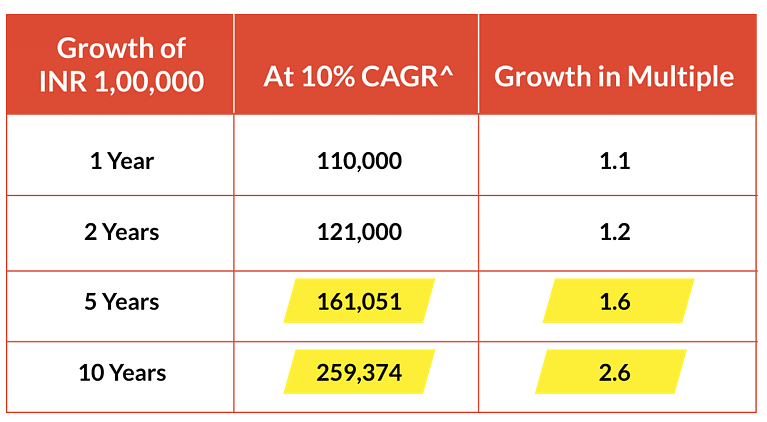

As depicted in the accompanying illustration, the growth of investments with a compounded annual growth rate (CAGR) of 10% starts off gradually during the initial two years but experiences significant growth by the fifth year, ultimately more than doubling over a decade.

-

This phenomenon is referred to as compounding, which typically becomes noticeable after the fifth year of investing and beyond. Investors usually utilize compounding when their goal is to generate wealth.

-

When you invest in a Retirement Mutual Fund, which has a mandatory lock-in period of five years, you automatically benefit from the power of compounding.